Who Really Sets Prices on the NGX: Retail Traders or Institutional Capital?

- momohonimisi26

- 2 hours ago

- 3 min read

The movement of prices on the Nigerian Exchange looks chaotic to many retail investors. Prices jump on low volume. Stocks drift for weeks. Sudden reversals appear without warning. You might think retail traders drive these moves because they trade more frequently. That view misses how price discovery works on the NGX.

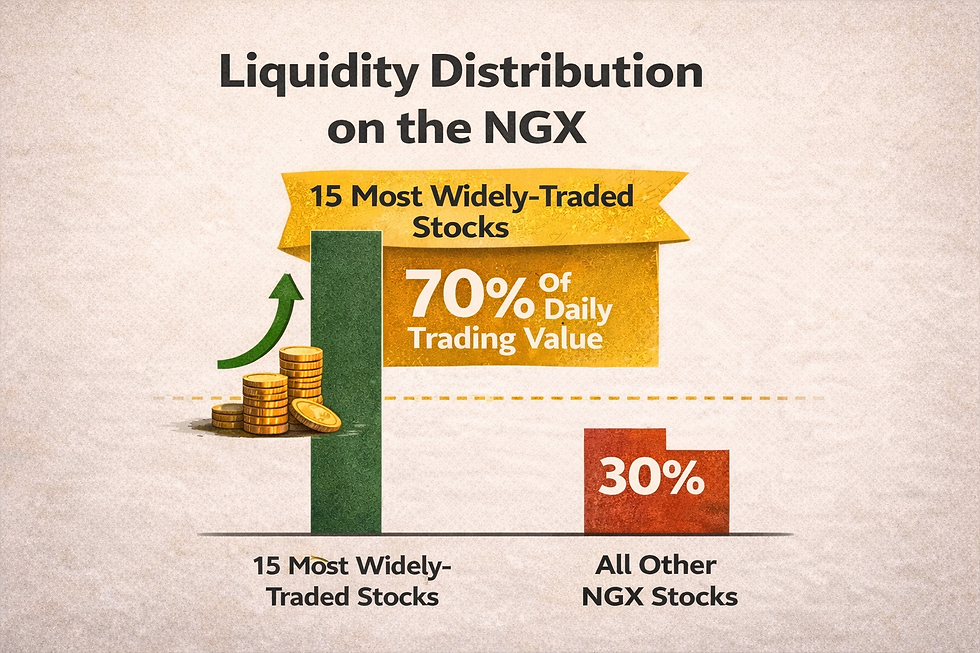

Price discovery refers to the process by which the market agrees on a price at any given moment. On the NGX, price discovery depends less on the number of traders and more on who trades with size. The Nigerian Exchange Limited runs a market with uneven liquidity. A small group of stocks accounts for most daily trading value. Many listed companies trade infrequently. Some record no meaningful volume for days. This structure shapes who controls price direction.

Retail investors dominate trade count. Institutions dominate trade value. This difference matters more than most people realise. Retail traders influence short-term movement. Institutional capital sets direction.

And liquidity explains why.

Liquidity describes how easily a stock absorbs buy or sell orders without large price changes. On the NGX, liquidity concentrates in a narrow group of names. Banks, cement producers, consumer goods leaders, telcoms, outside this group, depth drops sharply. When liquidity stays thin, the largest orders reshape the order book. Small trades add noise. Large trades move price levels. Retail traders usually place small orders. They trade during similar hours. They react to price moves rather than initiate them. Their trades cluster around news, price spikes, or social chatter. This behaviour increases volatility but rarely defines a trend.

Institutional investors behave differently. Pension funds, asset managers, insurance portfolios, and foreign funds trade with intent. They plan entry levels, split orders across sessions, and watch liquidity closely. Their goal focuses on position building rather than short-term movement. A single institutional order often outweighs hundreds of retail trades. Even when volume appears low, institutional accumulation reshapes supply and demand.

Retail traders amplify moves after institutions act; they rarely start the move.

Foreign portfolio investors magnify this effect. When foreign flows return, price discovery tightens. These investors trade larger blocks. They focus on liquid names while adjusting portfolios based on benchmarks and currency exposure. Their trades alter valuation bands even when participation remains limited. When foreign flows leave, volatility rises. Retail activity increases, weakening directions, and prices swing wider because there is no large buyer to anchor demand.

Data from NGX transaction reports shows this pattern clearly. In periods with strong institutional participation, average daily price ranges narrow. In periods dominated by retail trades, ranges widen while volume stays uneven. Understanding this structure helps you avoid common retail mistakes.

Many retail investors chase price breakouts on low volume. They read upward ticks as strength. Without institutional participation, these moves fade quickly. Others panic sell during sharp drops without checking who sells. Institutional exits create sustained pressure. Retail selling creates spikes, then reversals. To improve results, you closely watch the value traded rather than the trade count. Rising value alongside stable price signals accumulation, and falling value during price spikes signals exhaustion.

For active traders, this reality should shape how you build strategies. The focus should be on stocks with consistently traded value rather than momentary price spikes. Price moves that occur without meaningful volume are often signals of thin liquidity, not genuine demand. Reacting to every tick in such conditions leads to poor entries and emotional exits. And for long-term investors, Institutional flows tend to define valuation ranges long before retail participation becomes visible. Earnings still matter, and policy shifts still matter, but liquidity is often the gatekeeper that determines whether those factors translate into sustained price movement.

Retail traders play an important role in the ecosystem, but institutional capital ultimately decides direction. Understanding who controls price discovery does not eliminate risk, but it removes confusion. You stop attributing every unexpected move to manipulation and begin reading the structure beneath the market. Prices move because capital moves, and on the NGX, the largest pools of capital speak the loudest

Comments